What Is A Rule 4 In Horse Racing?

Horse racing has never been so popular in the world of betting and provides a multitude of opportunities for bettors to engage in the excitement of the sport. With horse racing, comes various regulations and rules that you should be aware of and one of the most significant is the Rule 4.

A Rule 4 deduction can potentially have a big impact on any returns you get back from your bets. Understanding the Rule 4 is very important for bettors who are serious about their horse racing and even more so for those who engage in Matched Betting.

During this article, you'll find out what a Rule 4 is, when they are applied, the calculations associated with Rule 4 and the potential impact it can have.

Rule 4: An Explanation

The Tattersalls Committee first issued rules on betting in 1886 and they work in conjunction with the Gambling Commission. Tattersalls primary role is to be an appointed adjudicator for any disputes between bookies and their customers. In order to do this, there have to be rules in place to see if there is a case to answer. Among those many rules is Rule Number 4 or R4 as it’s also known in betting circles.

If a Rule 4 is declared in a horse race, it determines how bookies amend returns if there is a non-runner. A non-runner is deemed as a horse that’s withdrawn before a race starts but bets have already been placed on it. If there is more than one non-runner, there may be more than one R4 deduction applied to the race. The purpose of the Rule 4 is to ensure fairness across the betting system as non-runners have the potential to affect the race dynamics and odds significantly.

In summary, if a horse becomes a non-runner, the chances of the remaining horses winning increases. To cover this, bookies declare Rule 4 deductions to bets made before the horse was withdrawn, meaning a reduction in odds of each of the remaining horses. The new odds are meant to reflect the bettors chances of success.

Important – There isn’t always a Rule 4 deduction. If a horse with odds of 14/1 (15.0) is withdrawn, there is no Rule 4 declared for that horse not running.

When Is A Rule 4 Activated?

Bookies apply a Rule 4 to a horse race when a runner is withdrawn after the betting market has opened but before the race has started. However, be aware that the Rule 4 only impacts any bets that were placed before the horse was withdrawn. If you place a bet after the Rule 4 deductions has been applied, it won’t affect your bet as the bookies will have already adjusted the odds to reflect the new race conditions.

If you are ever unsure if a Rule 4 has impacted your bet, you can check what time the Rule 4 was declared on the bookies website and then cross check that with the time you placed your bet.

Rule 4 Triggers

- Non-runners: If a horse is pulled out on the day of the race, a Rule 4 is likely to be declared.

- Weather Conditions: Some horses are not suited to certain conditions so adverse weather such as heavy rain can cause horses to be withdrawn from races on race day.

- Vet Intervention: It’s possible that a vet may recommend that a horse is withdrawn from a race after the betting market has opened. This could lead to a Rule 4 announcement.

- Jockey Problems: A Rule 4 can be invoked if a horse is declared a non-runner because a jockey has been injured in a previous race or falls ill.

Best Odds Guaranteed: An important thing to remember is that when a R4 is declared in a race where the bookie is offering Best Odds Guaranteed, the R4 will still apply. However, if the Starting Price (SP) of your wager is higher than the odds you backed at minus the R4 deduction, you’ll still get the BOG.

Rule 4 Deduction Calculations

As you’d expect with horse racing, there’s always calculations involved and a Rule 4 is no different and has plenty of deduction variations. Before you’re overloaded with a deluge of figures, let’s look at some of the factors considered to determine R4 calculations:

- The Rule 4 deduction is dependent on how likely the withdrawn horse(s) were to win the race.

- The deduction differences are based on a horses potential to win the race. For example, if the favourite was pulled from the race it makes it a lot easier for the second favourite to stand a chance of winning. On the other hand, if a horse with high odds is withdrawn, it is unlikely to impact the chances of the favourite and second favourite.

- The amount of a R4 deduction is calculated on the odds of the non-runner at the time it’s withdrawn. This is because the odds equate to a horses likelihood of winning. The lower the odds, the higher its chance of winning, and the higher the R4 deduction will be.

- The Rule 4 deductions are based on each £1 won. So, if your horse came first and you won £100 but there was a 10p R4 deduction, you would only win £90.

- The Rule 4 deductions are scaled based on the odds of the horse(s) withdrawn.

The table below details the official Rule 4 deductions that are in force across the global racing industry.

| Odds (Fractions) | Odds (Decimal) | Deduction |

| 1/9 or lower | 1.11 or lower | 90p in £1 |

| 2/11 to 2/17 | 1.18 to 1.12 | 85p in £1 |

| 1/4 to 1/5 | 1.25 to 1.20 | 80p in £1 |

| 3/10 to 2/7 | 1.30 to 1.29 | 75p in £1 |

| 2/5 to 1/3 | 1.40 to 1.33 | 70p in £1 |

| 8/15 to 4/9 | 1.53 to 1.45 | 65p in £1 |

| 8/13 to 4/7 | 1.62 to 1.57 | 60p in £1 |

| 4/5 to 4/6 | 1.80 to 1.66 | 55p in £1 |

| 20/21 to 5/6 | 1.95 to 1.83 | 50p in £1 |

| Evens to 6/5 | 2.00 to 2.30 | 45p in £1 |

| 5/4 to 6/4 | 2.25 to 2.50 | 40p in £1 |

| 8/5 to 7/4 | 2.60 to 2.75 | 35p in £1 |

| 9/5 to 6/4 | 2.80 to 3.25 | 30p in £1 |

| 12/5 to 3/1 | 3.40 to 4.00 | 25p in £1 |

| 16/5 to 4/1 | 4.2 to 5 | 20p in £1 |

| 9/2 to 11/2 | 5.50 to 6.50 | 15p in £1 |

| 6/1 to 9/1 | 7 to 10 | 10p in £1 |

| 10/1 to 14/1 | 11 to 15 | 5p in £1 |

| Over 14/1 | Over 15 | No Deduction |

As you can see from the above table, the lower the odds of the non-runner, the bigger the R4 deduction is. For example, if a horse with odds of 1.20 (1/5) is withdrawn, any winnings would be reduced by 80% (80p in the pound). If the withdrawn horse was at odds of 13.00 (12/1) then the deduction would be 5% (5p in the pound).

NOTE – Some bookies don’t make a deduction when the R4 is 5p in the pound. This is allowed because it is done in favour of the customer and not the bookmaker. It’s worth checking the individual bookies terms when this happens.

Rule 4 Example

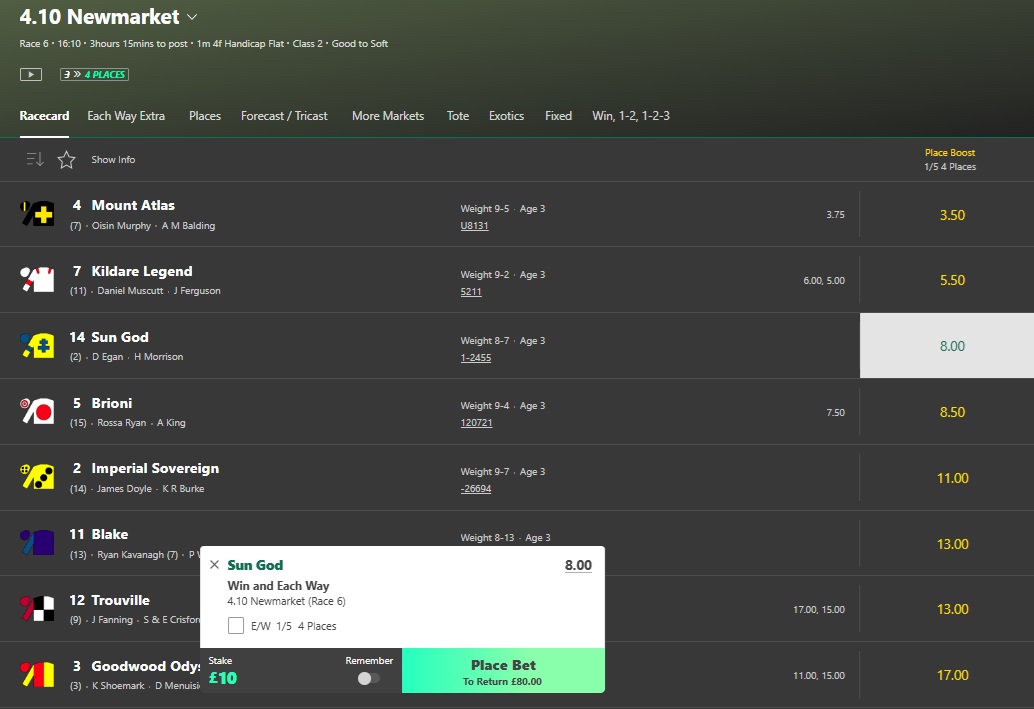

Let’s say you have decided to place a £10 bet on Sun God at odds of 8.00 (7/1) in the 4.10pm race at Newmarket as per the below image:

As you can see, should the horse win, you would get £80 returned (£70 profit plus your original stake back). At the time of placing your bet, all the horses were running and no withdrawals had taken place.

About 20 minutes after you placed your bet, the horse Imperial Sovereign was withdrawn. Because Imperial Sovereign had odds of 11 (10/1) at the time it was declared a non-runner, a Rule 4 deduction would be applied.

Because the odds were relatively high, the Rule 4 is only 5% (5p in the pound) and has a minimal affect on your bet. This is how the Rule 4 would impact your bet:

- Original returns: £80

- 5% Rule 4 deduction: £4 reduction (5% of £80)

- New returns: £76 (£66 profit plus your original £10 stake)

This scenario didn’t have that much of an impact on your potential returns so let’s turn it on its head and do another example where the Rule 4 has a bigger impact.

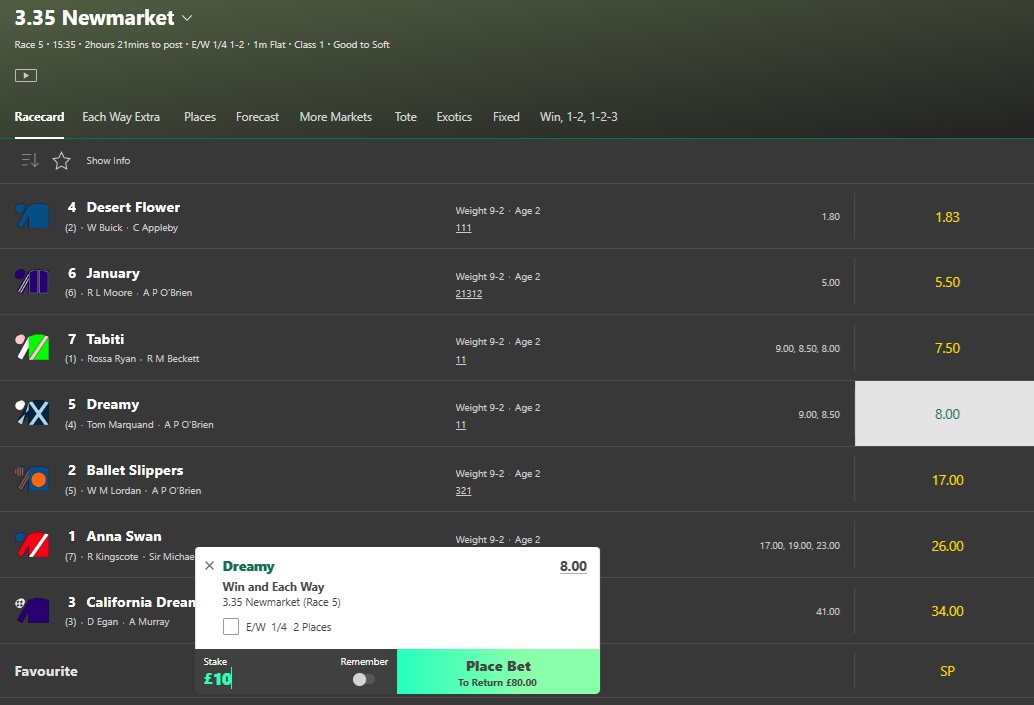

This time you have decided to place a £10 bet on Dreamy again at odds of 8.00 (7/1) in the 3.35pm race at Newmarket as per the below image:

As with the previous example, should Dreamy win, you would get £80 returned (£70 profit plus your original stake back). At the time of placing your bet, all the horses were running and no withdrawals had taken place.

This time, the favourite, Desert Flower has been withdrawn after you placed your bet on Dreamy. Again, because the odds of Desert Flower were 1.83 (5/6) at the time it was declared a non-runner, a Rule 4 deduction would be applied.

Because the race favourite has been withdrawn, the Rule 4 is a lot higher this time at 50% (50p in the pound). This is how the Rule 4 would impact your bet:

- Original returns: £80

- 50% Rule 4 deduction: £40 reduction (50% of £80)

- New returns: £40 (£30 profit plus your original £10 stake)

As you can see from these examples, a Rule 4 can have both minimal and huge impacts on your bets.

How Do You Know If There Is A Rule 4 Declared?

This isn’t as transparent as you might hope and there isn’t one place that will provide details of all the Rule 4 declarations.

Some bookies don’t let bettors know about the Rule 4 deduction unless their horse wins and then they will add the details of the deduction in the settled bet section.

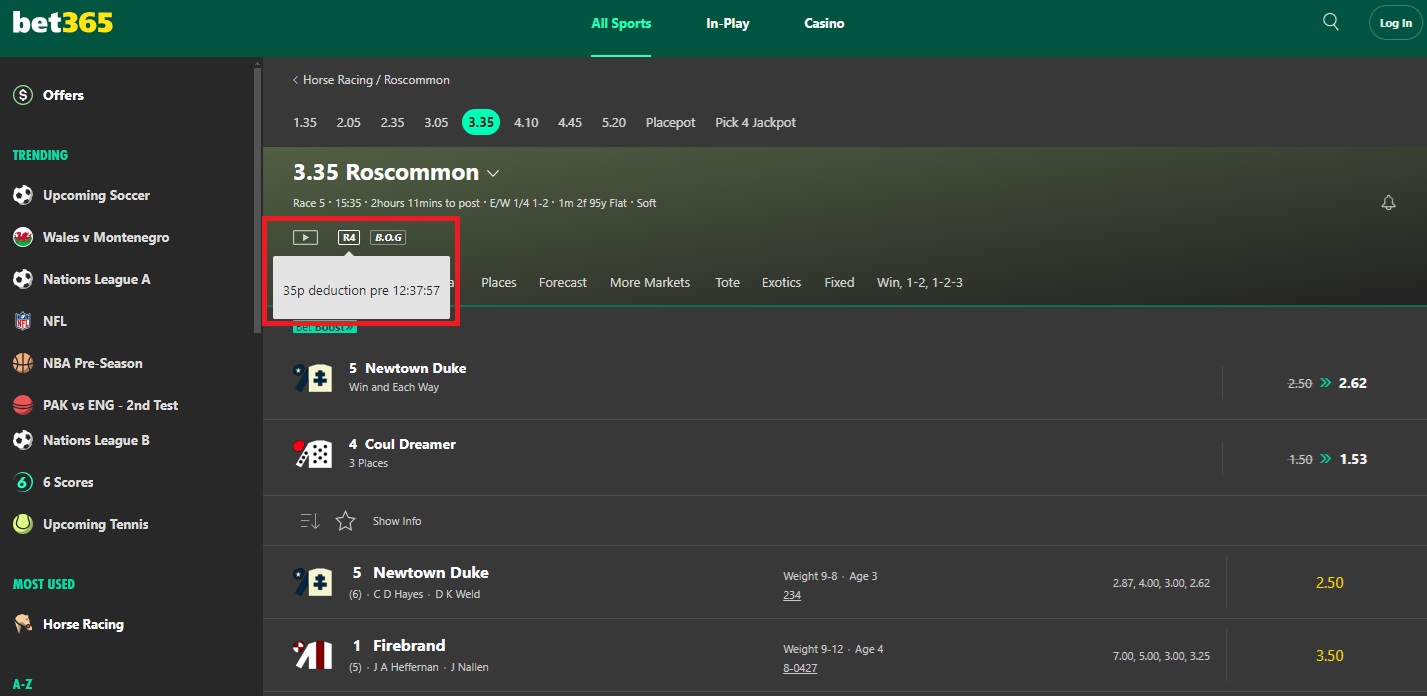

However, Bet365 are very good with letting their customers know about any Rule 4 declarations. If there has been a Rule 4 declared, bettors will be able to see this on the race card as below:

To see what the deduction is you just need to hover over or tap the R4 symbol. This will then reveal the deduction in the pound and exactly what time it was declared.

How a Rule 4 Can Impact Your Bets

As we have mentioned, a Rule 4 can significantly have a impact on your bets and especially if you are placing wagers on multiple horses or using large stakes. What impact can a Rule 4 have on different types of bets?

Single Bets

This is the simplest bet to deal with if there’s a R4 deduction. It will be a straight deduction as per the Rule 4 deduction table. Obviously, if a favourite is withdrawn, the reduction on your profits can be substantial.

Multiple Bets

The Rule 4 gets a little more complicated when it comes to bets involving accumulators, doubles and trebles. The Rule 4 in these types of bets doesn’t apply to the whole bet but only that leg of the wager.

Each-Way Bets

As we know, each-way bets are constructed of two parts, one for the horse to win and one for the horse to place. If a Rule 4 is declared, it will be applied to both elements of the bet.

Forecast & Tricast Bets:

With forecast and tricast bets you are predicting the order of the top two or three horses in the chosen races. Should one of the horses from your forecast or tricast be withdrawn, a Rule 4 deduction would apply to the bet. However, the impact of the R4 is complex and can vary depending on the race and horses involved.

Be Prepared for Rule 4 Deductions

Whilst Rule 4 is a well known industry standard, it can still throw out surprises if bettors don’t pay attention. Let’s have a look at things bettors should keep in mind:

Keep an eye on the odds:

If there’s a big shift in the odds on a race, it could indicate that one of the runners is about to be withdrawn. This can be very important if you’re putting bets on hours in advance of the race start.

Watch out for non-runner announcements:

If you are putting bets on close to the race start time, make sure you check for any withdrawals prior to placing your bets. Bookies have to declare non-runners as soon as they are advised about it so check the race cards or you can check non-runners on websites such as the Racing Post.

Consider when to place your bets:

If you want to avoid any Rule 4 deductions, it might be worth placing bets close to the race start as it’s unlikely there will be withdrawals at a late stage. This can remove any uncertainty about odds adjustments.

Understand the Rule 4 deductions:

Make sure you understand how the Rule 4 deduction system works and get familiar with the Rule 4 table. This can help you estimate the impact of any R4 deductions. Outplayed provides a Rule 4 Calculator to quickly work out your new returns.

Rule 4 Frequently Asked Questions

What is the biggest Rule 4 deduction?

The maximum a bookie can deduct under a Rule 4 deduction is 90% (90p per £1).

Do all bookmakers use the Rule 4?

Yes, Rule 4 is an industry-standard regulation that all licenced bookies within the UK and Ireland must follow. Most bookies outside the UK and Ireland follow similar rules but the specific might vary.

What happens if there are multiple horses withdrawn from a race?

More than one Rule 4 can be applied to a horse race. However, the total Rule 4 can never exceed 90% (90p per £1).

Does Rule 4 apply to ante-post betting?

Ante-post bets are bets that have been placed before the race market has opened at the course. Because ante-post bets are placed so far in advance of the race, before any final declarations are made, the Rule 4 does not apply. If the horse you bet on is withdrawn, you may lose your stake unless the bookie offers a refund on non-runners.

Does a Rule 4 impact my original stake?

No, the Rule 4 only impacts the profits from a winning bet. Should your horse win, you will always get your original stake back in the returns.

What happens when there are withdrawals from reformed markets?

When there’s been a withdrawal and a Rule 4 has been applied, the market is reformed at the new odds. If a subsequent horse is then withdrawn from the reformed market, the total deduction is calculated on the original market prices.

For example, you backed Horse A at odds of 7 (6/1) in the 3pm at Newmarket which has only four runners. A Little later on, Horse B is withdrawn at 10am and then at the start of the race, Horse C refuses to let the rider on so is also withdrawn just before the off at 2.55pm.

At the time Horse B was withdrawn, the odds for Horse B were 2.75 (7/4) and Horse C was 7 (6/1). Therefore, any bets placed before 10am (when Horse B was withdrawn) were subject to a Rule 4 deduction of 45p in the pound. This deduction is made up of two deductions, 35p for Horse B and 10p for Horse C.

After the initial Rule 4 at 10am, the market was reformed and Horse C was then priced at 3.5 (5/1). At 2.55pm another Rule 4 was declared and when Horse C was withdrawn which means the new Rule 4 was subject to a deduction of 25p in the pound.

Any bets placed after 2.55pm when the market was reformed for a second time weren’t subject to any deductions.

Summary

Rule 4 is an integral part of betting on the horse because it ensures that the odds are reflected fairly when horses are withdrawn from races. When bookies make Rule 4 deductions, they are simply levelling the playing field for all bettors. Yes, whilst a Rue 4 deduction can have a big impact on your bets, it helps keep the betting market on an even keel and fair.

A Rule 4 doesn’t have to impact your betting strategy in a major way provided you keep up-to-date with any withdrawals from races you’re betting on. It’s important you understand how the Rule 4 deductions work and it’s handy to have access to the Rule 4 table if possible.

Whether you’re new to betting or a seasoned bettor, it’s highly likely you will come across a Rule 4 when doing your bets. If you understand the rule, you should continue to enjoy your betting.

Updated: 27 Nov 2024

The Author

Paul brings over four years of Matched Betting experience to Outplayed. His extensive background in financial services and e-commerce, combined with his expertise in online marketing and Matched Betting, makes him a valuable asset to the team.