Kelly Criterion Betting System: Optimising Bet Stake Sizes

Kelly criterion is a mathematical formula that gives a stake size that will maximise the expected growth rate of your bankroll.

When using methods such as the Matched Betting strategy, you'll be laying off your bookmaker bets at an exchange to often guarantee a profit from offers, hence the name Matched Betting.

Ordinarily there's rarely a need to think about how big your stakes should be.

After all, you're balancing it out with the exchange lay anyway, so your risk is minimal. Moreover, most of the offers where you're laying your bets will have a set stake size in order to qualify for the promotion (e.g. Bet £20 Get £10 Free Bet).

This all changes completely when you delve into the world of value betting. For example, if you go for a "No Lay" strategy for Extra Place offers, or you know a bookmaker has a selection that is overpriced and you can't/won't lay it.

Here, since you're not balancing out your bets with an exchange lay, the amount you stake on the bet is very important. You don't want to stake so much that you risk rapidly losing your whole betting bankroll (and thus don't have the money to take advantage of future profitable bets). But at the same time, you don't want your bet sizing to be so small that you're not gaining as much value from your bets.

This is where the Kelly criterion comes in. It takes into account all the important things: the size of your bankroll, the payout if you win, the loss if you lose, and the probabilities of these outcomes happening.

Kelly Staking on the Outplayed Software

Within the Settings of the Extra Place Master (when you have No Lay mode selected), you'll see the option to fill in your bankroll amount and also select Kelly staking.

And that's all the hard work done for you in terms of calculating how much you should stake!

Now when you load up the calculator for a selection, it'll give you the recommended stake based on your bankroll and all the other important information specific to that bet.

Fractional Kelly Staking

Before we go into how the Kelly stake amount is derived, it needs to be said that the stake the Kelly formula gives is often pretty brutal. That's to say that the stake that's optimal for growing your bankroll is bigger and therefore riskier than is really necessary.

This is why Outplayed's software defaults to fractional Kelly stakes. It simply takes the optimal stake that the Kelly formula would give and then divides it. The recommended amount is 0.25 (i.e. the stake that will be recommended by the software is a quarter of the optimal Kelly stake).

This will give a much more sensible and balanced stake amount.

So are you throwing away value by not betting with the fully optimal stake amount?

Well, yeah, some.. But the upside is you can stake a much smaller amount and still achieve a similar value in terms of bankroll growth rate. This means much calmer downswings to your bankroll and a much smaller chance of having the doomsday scenario of losing your entire bankroll.

Let's take a look at an example bet with the following info:

- Your Bankroll: £1,000

- Bet Odds: 5.0

- Probability of the Bet Winning: 25% (i.e. the fair odds are 4.0)

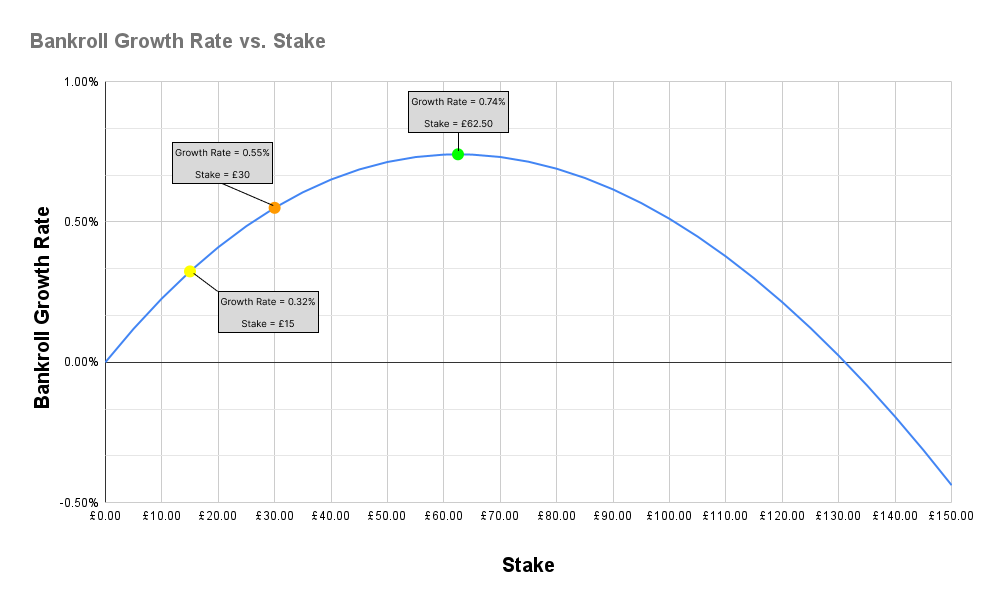

The Kelly Criterion maths (which we'll go into more detail with later) gives the optimal stake to maximise the expected bankroll growth as £62.50. This is the stake where the growth rate peaks on the graph below (the green point). It gives an expected bankroll growth rate of 0.74%.

The orange and yellow points show what happens to the growth rate if you go for a much smaller stake of £30 or £15. The £30 stake gives a growth rate of 0.55%, and the £15 stake gives 0.32%.

They do indeed lead to a lower average growth than a £62.50 stake, but are much less risky since they require a much smaller chunk of your bankroll.

The graph also shows that betting more than £62.50 in our example is completely redundant. The growth rate will only get further away from the maximum of 0.74%, and so you'll be taking on more risk for less reward.

Kelly Staking for Standard Bets

Outplayed makes life nice and easy in terms of the Kelly calculations. But let's take more of an in depth look at how the stake amount is calculated and how it can apply to other betting situations.

When I say a "standard bet", I mean one that can only have two outcomes: win or lose. Also, in the event of a loss, you'd lose the full stake amount (there's no partial money back going on here).

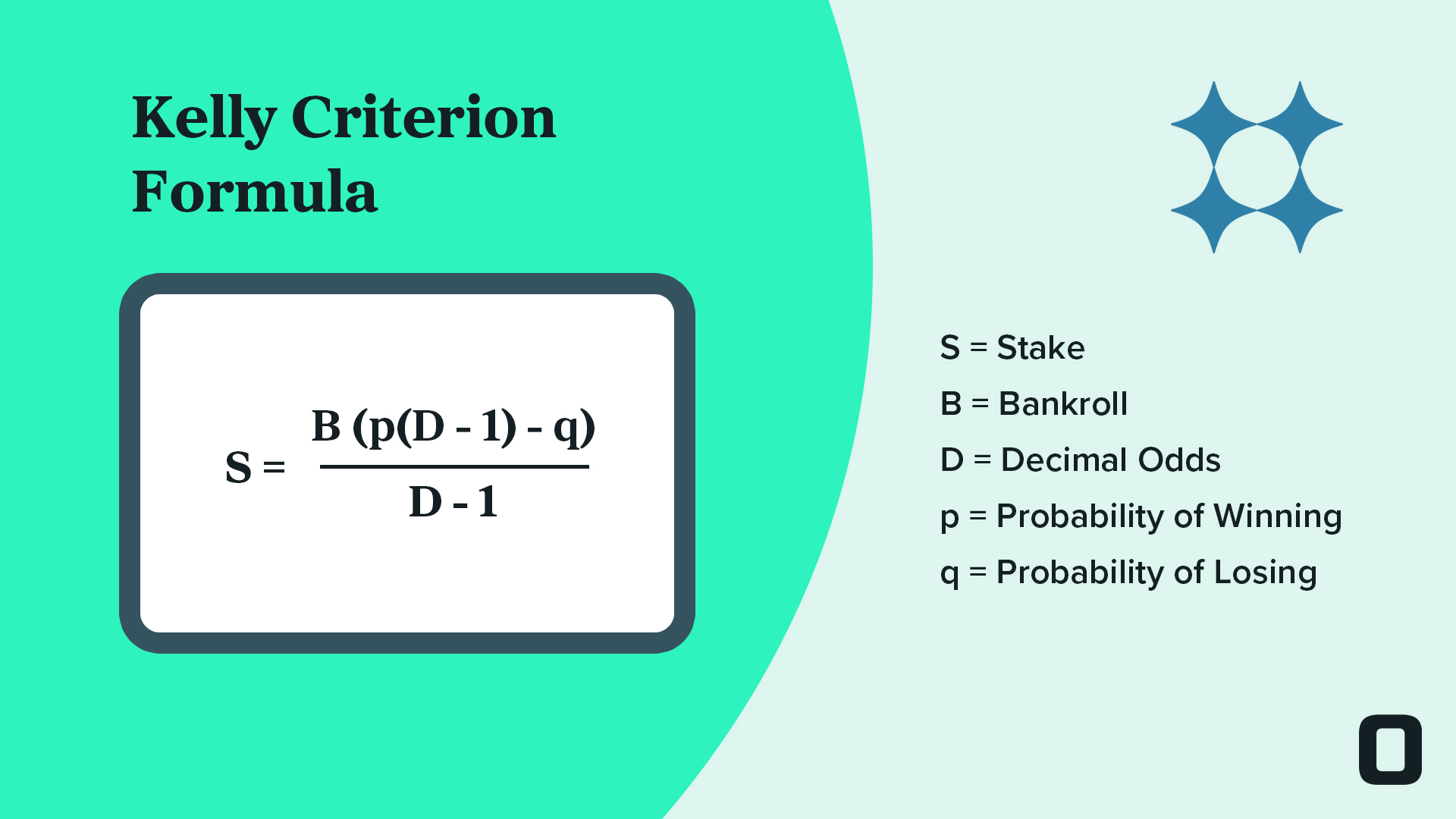

The formula to work out the optimal Kelly stake (S) is as follows:

This can look a little complicated at first, so let's go through it step by step with an example to show how you take all the information and calculate the stake size. I'll use the same example as the section above:

- Your Bankroll (B): £1,000

- Bet Odds (D): 5.0

- Probability of the Bet Winning (p): 25% (which is 0.25 for the sake of the formula)

- Probability of the Bet Losing (q): 75% (which is 0.75 for the sake of the formula)

This would be a great value bet to place if the bookie was offering odds of 5.0, but you believed that the true chance of that bet winning was more like 25%.

Step 1: Subtract 1 from the odds. 5 - 1 = 4

Step 2: Multiply this by the probability of the bet winning. 4 x 0.25 = 1

Step 3: Subtract the probability of the bet losing. 1 - 0.75 = 0.25

Step 4: Multiply by the bankroll amount. 0.25 x £1,000 = £250

Step 5: Divide this by the "odds - 1". £250 / 4 = £62.50

So we now know that the stake size that maximises the expected long term bankroll growth is £62.50. You can now apply the fractional Kelly as mentioned in the previous section.

It'd be as simple as taking the £62.50 and dividing it by 4 (or whatever other fraction you deem sensible). £15.62 is the new stake amount after doing this. It'd be a good idea to round this up/down to £15 or £20 so you don't stand out like a sore thumb to the bookie.

Kelly Staking For Each-Way Bets

Each way bets work a little differently to your usual bet. They're essentially two bets in one. One of these bets on the selection to win, and the other bet on the selection to place (e.g. finish 1st - 4th).

This leads to three possible payouts instead of the standard bet, which gave two:

- Win - Both the win and the place bets win. This leads to the biggest profit.

- Place - The selection doesn't win, but it does place. This usually results in an overall profit but can sometimes be a small loss depending on the odds.

- Lose - The selection finishes outside the places, resulting in both the Win and the Place part of the bet losing. You will lose your full stake amount.

This third scenario throws a real spanner in the works when it comes to calculating the Kelly stake. Showing where this comes from and going into detail goes beyond the scope of this article.

It is very much the same concept though: finding the stake value that maximises the expected bankroll growth rate.

You don't actually need to know any of this to apply it to your betting. Outplayed's software instantly does all of these calculations for you and lets you know this stake amount when doing your each-way value betting.

Summary

The Kelly criterion formula is a great advanced concept for value bettors. It gives the stake that optimises your long-term expected bankroll growth. And after all, that's the main thing you're after!

When using Kelly stakes for betting purposes, the optimal stake can often be quite large, so using 50% or 25% of this amount can be an ideal balance of risk and growth.

It's nice to know where the numbers come from, but you don't need to do all the painstaking maths yourself. Outplayed will do this for you on our value betting software, so you'll always be using sensible stakes for your bankroll amount.

Updated: 8 Dec 2025

The Author

Ollie has been working for Outplayed for over 7 years and Matched Betting for many years before that. He provides a wealth of insights into every asset of this amazing side hustle, from the very basics to the most advanced and profitable bookmaker promotions. If you’re interested in the maths behind Matched Betting, Ollie is your guy!