What Is Value Betting? Everything You Need To Know

Value betting involves placing bets that are more likely to win than suggested by the bookmaker’s odds.

Value betting is a betting strategy that gives you an edge over the bookmakers by finding odds that are higher than they should be.

It involves accurately working out how likely an outcome is, then using this information to find ‘overpriced’ bookmaker odds and betting on these.

Unlike with Matched Betting, you won’t lock in a profit when placing a value bet.

But, if you can consistently find bets that have value to you – known as positive expected value (+EV) bets – you can make fantastic long-term profits from value betting.

Even better, value betting works with gubbed accounts.

In this article, you’ll find out about how bookmakers set their odds, different value betting techniques, and a range of value betting tools.

First, we’ll look at some key ideas that help us understand how to find value bets.

Fair Odds

Fair odds accurately reflect how likely a bet is to win.

A bookmaker offering fair odds would have no edge and would pay out as much in winnings as they took in losing bets over time.

With a coin toss, the chance of either heads or tails is 50%.

A bookmaker offering fair odds on a coin toss would pay double your stake if you won and take your stake if you lost.

To work out the return on a winning bet, the bookmaker multiplies your stake by the decimal odds. You win double your stake on a winning bet at fair odds for a coin toss, so the return on a £10 stake is:

Return = Stake x Odds = £10 x 2.0 = £20

£10 of this is just you getting your stake back, so the profit is £10.

There’s a 50% chance your bet wins, so you’ll make £10 profit half the time and lose your £10 stake the other half. Over time, you’ll break even, and so will the bookmaker.

The bookmaker would then go out of business quickly, which is why they don’t offer fair odds.

Implied Probability

Implied probability shows how likely an outcome is, as implied by the odds.

It’s a really important concept when it comes to value betting. Lower odds bets are more likely to win, and higher odds bets less likely.

To work out the implied probability of a bet, you divide 1 by the decimal odds. For the fair odds coin toss bet, this is:

Implied probability = 1 / 2.0 = 0.5 = 50%

We know the actual chance of either heads or tails is 50%. Since the implied probability of the bet is the same as the actual likelihood of it winning, we can see that the odds of 2.0 are fair.

Expected Value

In betting, expected value is the average profit you’ll make from placing a bet.

It takes into account the likelihood of the bet winning or losing, the profit you make if it wins, and the loss you take if it loses.

For a £10 bet on a coin toss at odds of 2.0, the expected value (EV) is:

EV = (0.5 x £10) + (0.5 x -£10) = £5 - £5 = £0

This is just a way of saying, with maths, that you win £10 half the time and lose £10 the other half. It also shows there’s no long-term value to this bet for either you or the bookmaker. We’ll look at how to find that value later.

The Bookmaker’s Edge

Bookmakers set their odds to ensure they profit in the long run. They work out the fair odds for a bet, then set their odds lower than this to give themselves an edge.

For a coin toss, they might lower the odds from fair odds of 2.0 to 1.9. This bet will return £19 if it wins (a £9 profit), and you’ll lose £10 if it loses.

The expected value is:

EV = (0.5 x £9) + (0.5 x -£10) = £4.50 - £5 = -£0.50

In the long-term, you’ll lose 50p on average for each £10 bet you place, meaning this is a negative expected value (-EV) bet.

The bookmaker, on the other hand, makes a 50p profit for every £10 staked. This is their edge, or margin, and is the key to how they make money from the bets they offer.

How Bookmakers Set Odds

Bookmakers use betting analysts, sports traders, and quants (quantitative analysts) to assess, as accurately as possible, the likelihood of an outcome.

The odds can then be set accordingly, making sure to reduce the odds a bit to factor in that all-important margin.

Some bookmakers also take into account odds from betting exchanges or other bookmakers when setting their own odds.

When two football teams play each other, betting analysts look at data, including previous results, recent form, expected weather conditions, team selection, and injuries.

They use this to predict the likelihood of the outcomes of a wide range of bets.

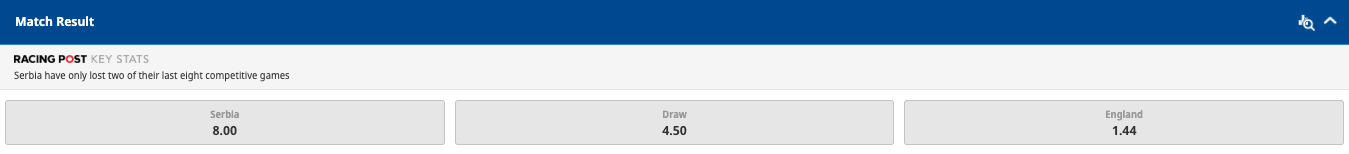

A bookmaker setting match odds for Serbia v England might assess the chances of the three possible outcomes as:

- Serbia win probability = 0.105 = 10.5%

- Draw probability = 0.215 = 21.5%

- England win probability = 0.68 = 68%

These correspond to fair odds of 9.52 for a Serbia win, 4.65 for a draw, and 1.47 for an England win.

To factor in a margin, the bookmaker lowers these odds to set their actual odds. For this game, they might have odds of 8 for Serbia, 4.5 for the draw, and 1.44 for England.

These are Betfred’s actual odds for the game. The imagined fair odds are an estimate of what these might be.

An educated guess was made that Betfred reduced Serbia’s odds by a much bigger factor than England’s, to take account of the favourite-long shot bias.

It’s been observed many times that bettors tend to bet on ‘long shots’ or ‘underdogs’ more than they should, based on the odds, so bookmakers can reduce the odds of long shots by more than they do with favourites.

Sharp and Soft Bookmakers

Bookmakers can be roughly divided into two types – sharp bookmakers and soft bookmakers.

Sharp bookmakers are aimed at professional bettors. They tend to have lower margins and adjust their odds very quickly, using sophisticated systems.

Sharp bookmakers set their own odds, using advanced systems and models.

Most of the process is automated, allowing them to react to events like player injuries quickly, often adjusting odds in a few seconds. They are also often the first bookmakers to create a particular betting market.

The initial odds offered by a bookmaker are called opening odds. They are often released late at night or early in the morning, so are also known as overnight lines.

Although they don’t operate in the UK, Pinnacle are often referred to as the sharpest bookmaker. They don’t offer sign-up or reload bonuses, so can afford to have smaller margins on their betting markets.

Pinnacle post opening odds with low betting limits of perhaps a few hundred pounds. ‘Sharp’ bettors – experienced, well-informed, and often professional bettors – are often the ones placing the first bets on these opening odds. Pinnacle then adjust their odds based on the betting activity of these sharp bettors, whose opinion they value.

Once Pinnacle have refined their odds from their opening odds, they can confidently increase their betting limits to as high as £50,000 or more for some markets.

Due to their sophisticated methods, sharp bookmakers have very efficient odds. This means that, once the margin has been removed from their odds, they tend to be an accurate indicator of fair odds.

Many Asian bookmakers, for example, Dafabet and 188Bet, are generally considered to be sharp bookmakers.

Soft bookmakers are aimed at casual bettors. They tend to have higher margins and adjust their odds relatively slowly, often in response to odds changes at sharp bookmakers or exchanges.

Most well-known bookmakers, like Bet365, Paddy Power, Ladbrokes, and William Hill are soft bookmakers. They offer sign-up and reload bonuses and have bigger margins than sharp bookmakers.

Soft bookmakers don’t price their markets as efficiently as sharp bookmakers, so their odds tend to be a worse indicator of fair odds.

Despite their bigger margin, it can be easier to find overpriced odds with soft bookmakers, since their odds are more likely to be mispriced.

This can be exploited by value bettors, who can often bet on overpriced odds at soft bookmakers, extracting long-term value.

Exchange Odds

Exchange odds are set by bettors, and change as a result of supply and demand.

Betting exchanges use peer-to-peer betting, where bettors bet against each other, rather than taking bets offered by a bookmaker. Exchanges make money by charging a commission on winning bets, although you can get 0% commission with Matchbook with Outplayed membership.

Exchange odds arise differently to bookmaker odds. To form the market initially, individual bettors set their own odds. These odds then change as bets are placed. If more bets are placed on one outcome, these odds tend to drop, and the odds for the other outcomes in the same market increase.

As more bets are placed and more money enters the market, it becomes more ‘well formed’. The amount of money available to place bets (the liquidity) increases, and the gap between the back and lay odds (the spread) decreases.

New Yorker columnist James Surowiecki suggested a compelling idea in his book The Wisdom of Crowds.

He argued that “the many are smarter than the few”. In terms of betting exchanges, the suggestion is that a large number of people betting on a market, and causing the odds to change, often leads to odds that more accurately reflect the likelihood of the bet happening than bookmaker odds, set by experts.

Studies have shown a very close correlation between the implied probabilities of an outcome at betting exchanges and the likelihood of that outcome occurring.

A 3-year study by Franck, Verbeek and Nüesch, of all 5478 games played across the ‘Big Five’ football leagues (England, Spain, Germany, Italy, and France), showed that exchange odds tend to be a better predictor of actual results than bookmaker odds.

Source: SSRN

Another reason exchange odds are a better indicator of fair odds is that the odds aren’t reduced to create a margin, unlike at a bookmaker.

The idea of the wisdom of crowds isn’t perfect.

For example, if a bookmaker’s odds for Liverpool start to drop, just because lots of people decide to back Liverpool, this could lead to more people betting on them.

This would then cause the odds to drop further. Herd mentality could then ensue, with ‘fear of missing out’ leading to ever more bets placed on Liverpool.

Since there was no sound reason for the odds dropping, bets placed on Liverpool would have increasingly poor value the further the odds dropped.

How Value Betting Works

Value betting is the placing of bets on betting markets that have been overvalued by bookmakers.

It’s clear that the odds are literally stacked against us when we bet at a bookmaker.

However, if we can find bets that are more likely to win than implied by the bookmaker’s odds, we can give ourselves the edge.

This is the essence of value betting. The great news is that value betting allows you to continue to get value out of gubbed accounts.

One simple way to find these overvalued bets is to look for bookmaker odds that are higher than the lay odds for the same outcome at a betting exchange.

Outplayed’s rapid Oddsmatching tool is ideal for finding such opportunities.

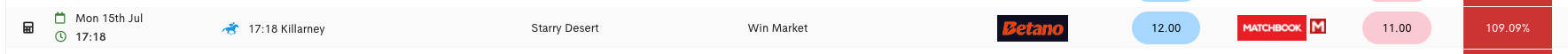

Here is a result from the Oddsmatching tool:

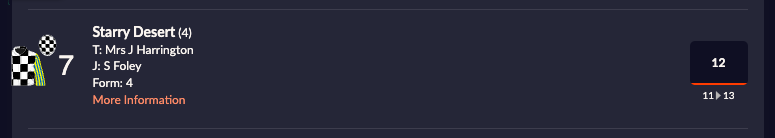

These are the bookmaker back odds of 12:

Here are the Matchbook Exchange lay odds of 11:

There are two ways to take advantage of these ‘too good’ bookmaker odds.

One is to back the bet at odds of 12 at the bookmaker and use a Matched Betting Calculator to lay the bet, giving an overall profit no matter what the outcome of the bet.

Covering all outcomes on an event and locking in a profit is known as arbitrage betting (arbing).

The other approach is to place the bet at the bookmaker without laying it.

Although this won’t lock in a profit, the bet will have long-term value.

This is because the lay odds of 11 are a good representation of fair odds.

The bookmaker’s odds of 12 are better than the fair odds, so betting on them will therefore be profitable in the long-term.

This will be explored later in the each way betting section.

Asymmetric Information

Asymmetric information is where a bettor has knowledge or data about a betting market that is not generally available.

A bettor with access to information about a betting market that is not available to most people, including those involved with setting bookmaker odds, has a potential advantage when betting on that market. They can use this information to place bets that have long-term value.

Examples of asymmetric information are being in possession of early news about a sporting event, for example a player injury or withdrawal, or having a greater insight into a betting market’s statistics.

It’s much harder to have an edge like this in high-profile competitions like the Premier League. This is why some bettors specialise in obscure sports, leagues, and betting markets. Examples include lower leagues, less-followed foreign football leagues, and infrequent events like the Olympic Games.

In these markets, there is far less information available, and of lower quality, compared to higher-profile events. Bookmakers will be less able to set their odds accurately as they are with higher profile events, giving an edge to sharp bettors who have superior information.

Chasing Steam

Bookmaker and exchange odds aren’t static, changing in response to bets placed on the market. Odds sometimes change suddenly and simultaneously at multiple bookmakers.

This sudden change is known as steam.

There can be numerous causes of this change, including team news, player injury, weather, insider knowledge, or sharp bettors having differing opinions to the bookmakers on their odds.

The type of change of interest to us is one caused by expert opinion, whether that’s from professional gamblers or betting syndicates. When this leads to a large volume of bets being placed on a certain outcome within a short space of time, this causes a dramatic and rapid odds change.

Following these sudden changes of odds is called “steam chasing”. As long as there’s a sound reason for the odds change, one way to capitalise on this is to place a bet with a bookmaker that is slower to respond and hasn’t yet cut their odds.

Each Way Betting

Bookmakers assess the chance of each horse winning a race and set their odds accordingly.

They also offer each way bets. A £10 each way bet consists of a £10 bet on the horse to win and a £10 bet on them to place (for example, to finish in the top 3 places).

Place odds are calculated according to the bookmaker's place terms, which are either 1/5 or 1/4 in horse racing.

Multiplying the fractional win odds by the place terms gives the place odds. With win odds of 10/1 (11.0) and 1/5 place terms, the place odds are one fifth of the win odds, at 2/1 (3.0).

Working out the place odds in this simplistic way is not a good way to create accurate place odds, as it doesn’t account for the number of runners, the odds of the other horses, or other factors like the ground or weather conditions.

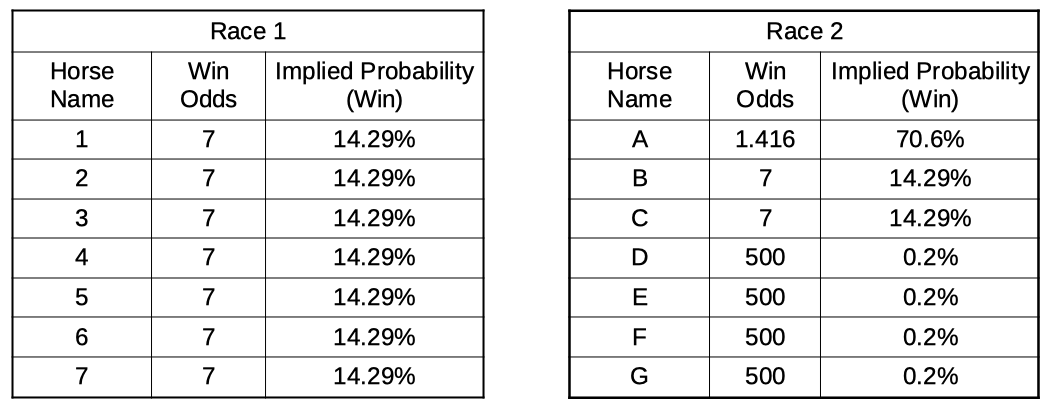

Let’s imagine two different races, both with 7 runners. The bookmaker is paying 3 places at 1/5 odds in each race.

In both races, the bookmaker has fair odds with no margin. In a fair market, the sum of all the implied probabilities is 100%.

With actual bookmaker odds, the sum of the implied probabilities is always over 100%, with the amount over 100% being called the overround.

If you add all the implied probabilities and it comes to 110%, the overround is 10%. The examples below are fair markets, so have no overround.

Race 1

Each horse in Race 1 has the same win odds and the same implied probability of winning (a 1 in 7 chance).

Race 2’s horses are much less evenly matched. Two horses have equal win odds of 7 and a 1 in 7 chance of winning the race. The favourite has around a 7 in 10 chance of winning and the five long shots have a 1 in 500 chance of winning.

The odds show that Horse A is by far the likeliest horse to win, and extremely likely to place. Horses B and C are much more likely to finish in the top 3 places than horses D to G, who are likely to finish well outside the top 3 places.

At 1/5 odds, the place odds for the 7 odds horses are 2.2. The implied probability for these horses to place is:

Implied probability = 1 / 2.2 = 0.454 = 45.4%

Let’s imagine each horse is also equally likely to place in the top 3. There are 7 horses, so there is a 3 in 7 chance of any of them placing. The actual probability any horse placing is:

Probability = 3 / 7 = 0.429 = 42.9%

This is lower than the implied probability, so there is no value in the place market for Race 1.

Race 2

In Race 2, the place odds are also 2.2 for the two 7 odds horses (Horse B and Horse C), with the same implied probability of 45.4% to place. Due to the four long-shot horses, who are very unlikely to place in the top 3, the actual probability of either of the 7 odds horses finishing in the top 3 places is likely to be much higher than 50%.

For example, if we worked out that the actual probability of Horse B placing was 60%, this corresponds to fair odds of 1 / 0.6 = 1.67. The bookmaker is paying 2.2 place odds, so there would be huge value in the place market for Horse B.

Two horses in a race with the same win odds aren’t necessarily equally likely to place. In Race 1, all horses have the same win odds.

However, perhaps Horse 1 tends to finish relatively strongly, even if he doesn’t win, and usually finishes in the top 3 places.

Horse 2 might be much more hit-and-miss about placing if he doesn’t win, usually finishing weakly and well outside the places. Despite identical place odds, Horse 1 would be the much better proposition to place an each way bet on.

Outplayed’s advanced Extra Place Master and Lucky Finder both use advanced algorithms to accurately work out the likelihood of each horse placing so you don’t have to!

Each Way Arbing

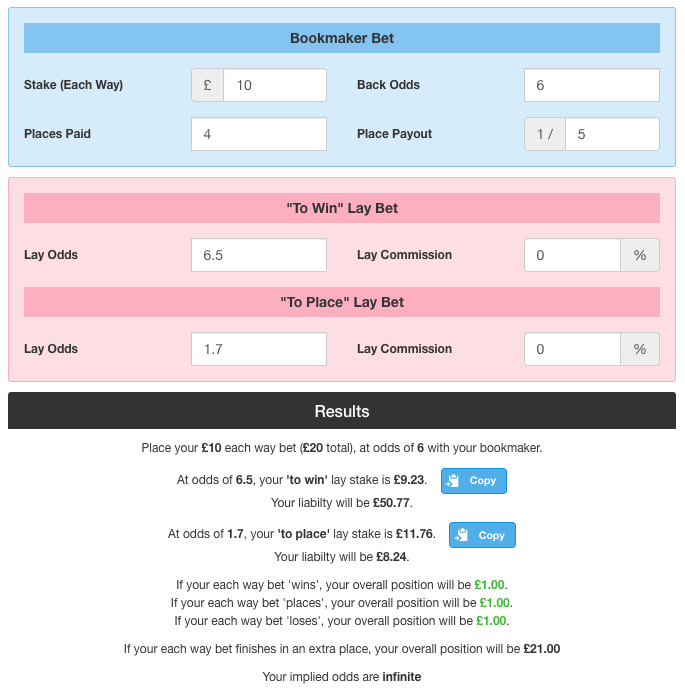

A horse with win odds of 6 will have place odds of 2 at 1/5 odds. If the exchange win lay odds are 6.8, placing a bet on the horse to win has negative expected value.

Placing a matched bet using Outplayed’s Each Way Calculator, you could lock in a profit on this bet, if the lay odds were 1.7:

Although the £10 win bet loses £0.76 (£9.23 - £10), the place bet gains £1.76 (£11.76 - £10), giving a £1 profit overall.

Locking in a profit with this method is a type of arbitrage known as each way arbing.

Each Way Value Betting

Using the example above, we might work out that the fair win odds are 6.2 (implied probability 0.161) and fair place odds are 1.6 (implied probability 0.625). Both of these are lower than the respective exchange odds, meaning there is more long-term value in not laying the bet. We can work out that the expected value of an unlaid £10 each way bet:

Win EV = (£10 x 6 - £10) x 0.161 + (1 – 0.161) x -£10 = -£0.32

Place EV = (£10 x 2 - £10) x 0.625 + (1 – 0.625) x -£10 = £2.50

Overall EV = £2.50 - £0.32 = £2.18

The EV is £2.18, which is over twice as high as the £1 that can be locked in by laying the bet.

Value Betting vs Arbitrage

Value betting and arbitrage have their pros and cons. Value betting has greater long-term value than arbitrage. However, although value betting leads to profit over time, it has a lot of variance, and you’ll inevitably face losses as well as gains. In contrast, although the value is lower from arbitrage, you lock in a profit every time.

Other Profitable Betting Strategies

All profitable betting strategies are based on value and gaining an edge over the bookmakers. Here are some additional strategies and tools that enable you to do this:

Summary

You’ve seen how bookmakers and exchanges work, how to find value in betting markets, and a range of techniques and tools to help you make substantial long-term profits from your bets.

Updated: 17 Feb 2026

The Author

Simon has helped thousands of members profit from Matched Betting using both his passion for writing and desire to understand how things work. He has used his mathematical and analytical skills to create several guides, calculators, betting and casino tools to make the process of Matched Betting easier for newcomers and experienced members alike.